The PitchBook Q1 2023 European Venture Capital (VC) Valuations Report revealed interesting and conflicting trends in VC valuations and deal sizes. The report attributes these trends to various factors impacting startups at diverse financing stages. Lower growth rates, workforce cutbacks, and stringent funding conditions characterised the period, leading to a plateau in the hitherto skyrocketing valuations, particularly in later financing stages.

The report noted a shift in focus towards profitability, away from unrestrained growth. In light of this, it is expected that more founders will adopt measures to enhance capital efficiency. The pressure from rising inflation, hikes in interest rates, and sluggish growth has undermined the expansion prospects for businesses seeking financing. The processes of due diligence have become more protracted, with revenue, valuations, and runways being subjected to increased scrutiny.

The report also showed a correction in the VC deal value involving non-traditional investor participation. This has been attributed to intensifying macroeconomic pressures and growing economic uncertainty, which have led to a decrease in non-traditional investor participation. Deal value involving these investors fell by a significant 65.3% YoY in Q1 2023, marking the lowest point since Q4 2021. Venture-growth stages were hit hardest, with median deal value plummeting to €11.3 million from €22.7 million in 2022. The expectation is that non-traditional investor involvement in private markets will remain low, as more liquid assets are prioritised in the face of economic instability.

Flatter valuations were also observed during the quarter, as the aggregate post-money valuations of all Europe-based unicorns steadied. Indicators of a cooler market were evident, and the report predicts that large rounds at high valuations will be rare in 2023. There is likely to be further downward pressure on valuations as capital becomes less available and businesses contemplate flat or down rounds over the subsequent quarters. Unicorns with high burn rates may be the first to feel the strain if recent expensive investments, coupled with current market conditions, hinder growth.

Lastly, the VC exit market displayed a subdued performance, with acquisitions demonstrating more resilience than public listings. The median exit valuation in Q1 declined by 34.8% YoY but experienced a 48.5% QoQ growth. The report noted divergence in valuation trends based on strategy, with the median acquisition value increasing QoQ to €29.6 million, while public listings saw a sharp decline of 47.1% to €42.7 million.

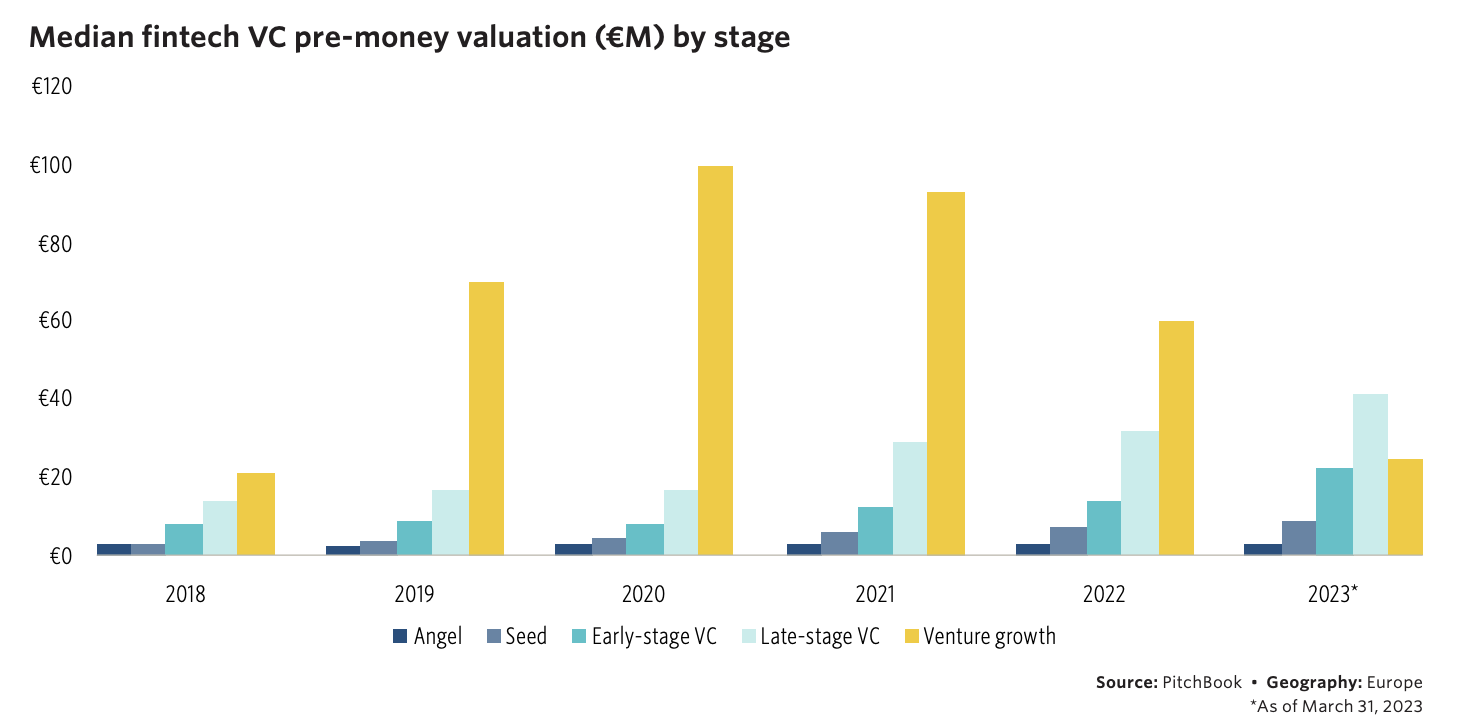

FinTech Sector

Fintech deal sizes and pre-money valuations grew, but challenging times remain ahead

Energy Sector

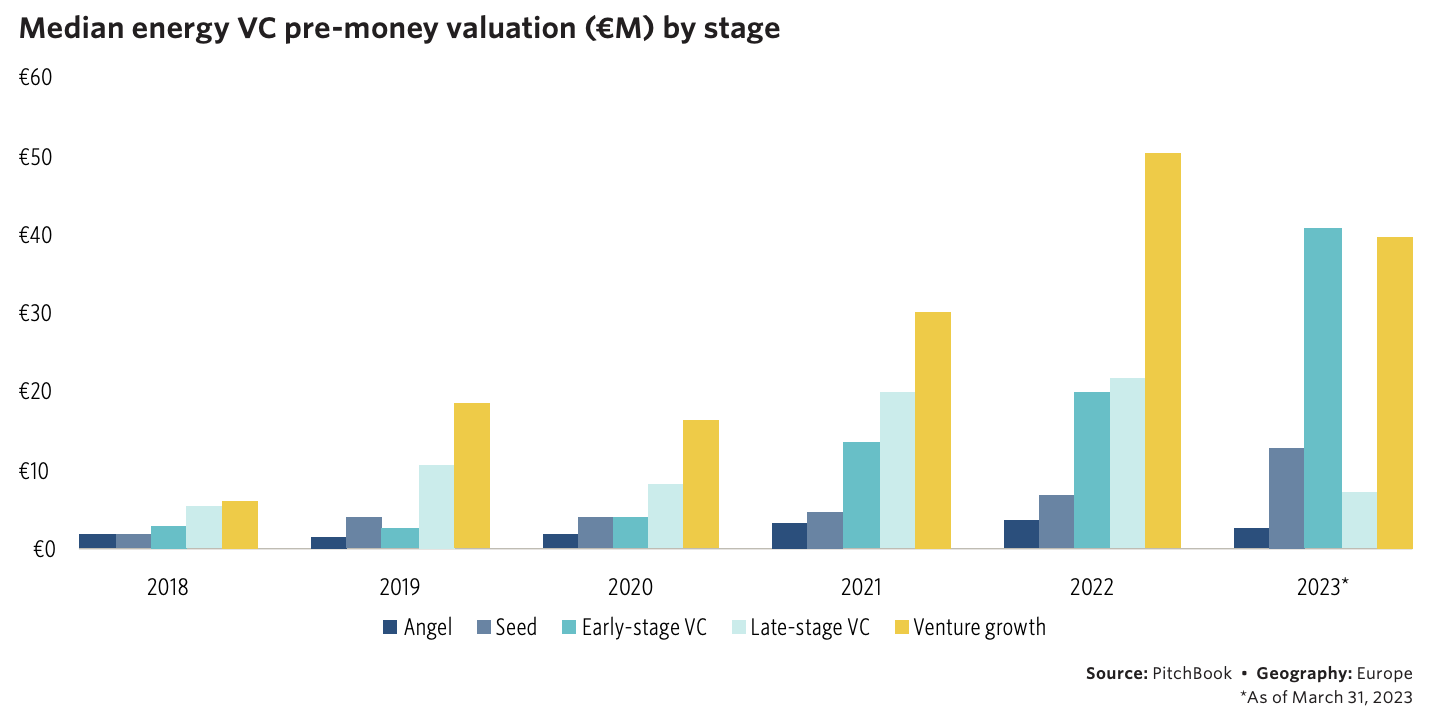

Q1 2023 saw mixed movements in energy sector valuations, as some heat seems to have been taken out of the market.

UK & Ireland Regions

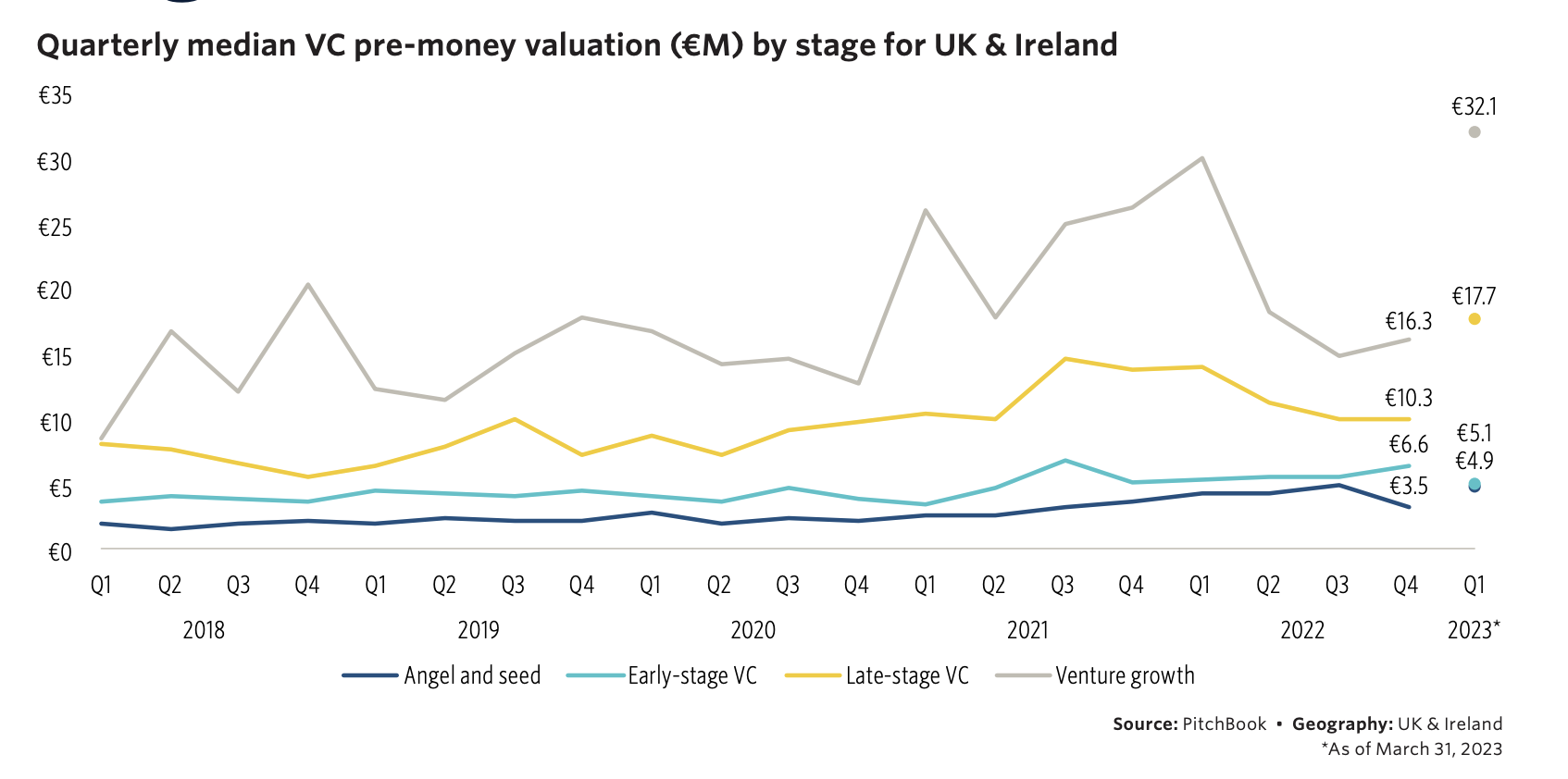

In the UK & Ireland, deal activity showed encouraging signs at the start of the year.