The most common way to value a company, is by using either Multiples Valuation, or Discounted Cash Flow calculations.

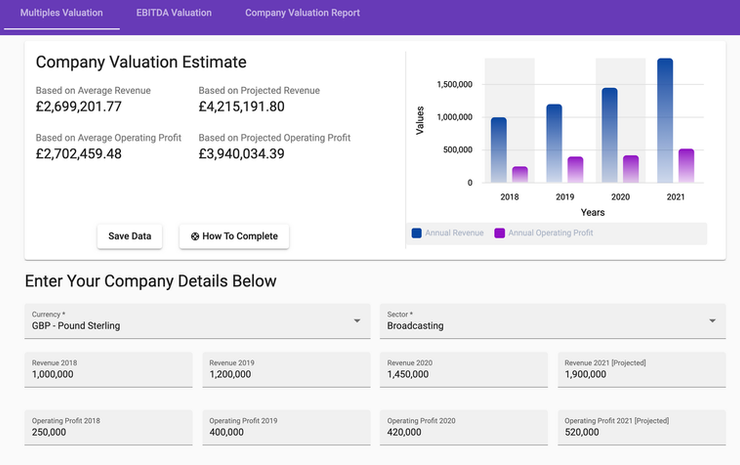

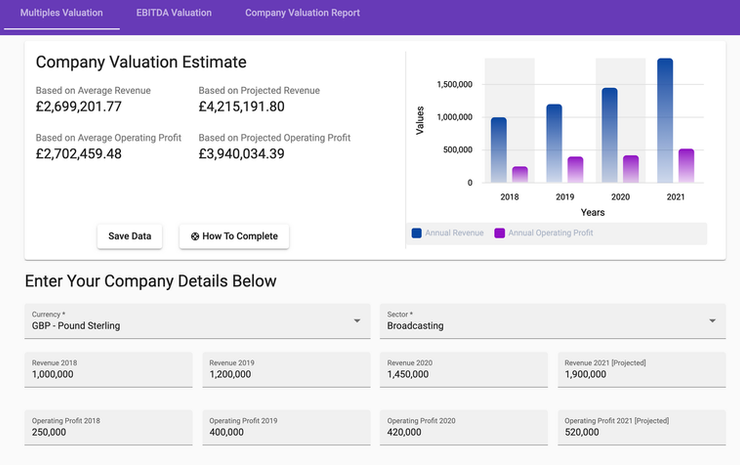

While you read our guide below, our free company valuation app can help kick-start your understanding of your company's valuation.

What is Multiples Valuation?

Multiples valuation or relative valuation uses the known market valuation of number of peers within a sector, usually listed companies as their valuation is easily obtained. This ratio is then applied to your own company to provide an estimate of its valuation. Multiples Valuation is therefore very much an estimate of your current valuation based on what the stock market believes are the future growth prospects of your listed peers rather than your own companies future potential. A typical example is accountants, which have a multiple of 1.5 to 2x versus a FinTech that has multiples of 15x or more.

Discounted Cash Flow (DCF) is generally considered the most accurate method for valuing a company. In DCF, future cash flows are estimated and then discounted by the cost of capital to give their present values. This means DCF is more about the future growth and profit than past performance.

In order to calculate DCF, you therefore need to have your current cash flow with estimates of future cash flows and your cost of capital.

Our free company valuation app uses adjusted EBITDA rather than the free cash flow, which while giving better results may be harder for you to find.