Welcome to M&A Deal Platform Help & Support Page.

We are here to assist you with any questions you may have about our platform and below you will find help guides and videos on each of the platform features.

Please feel free to book a 15-minute or 30-minute online training session, to learn more about the platform's features, functionalities, account management, troubleshooting, or any other related topics.

If you have an urgent query, please feel free to contact us:

We hope you enjoy our platform!

James Ruthven

Co-Founder M&A Deal Platform

M&A Deal Platform Documentation

Learn how to use the M&A Deal Platform is broken down into the different functions below.

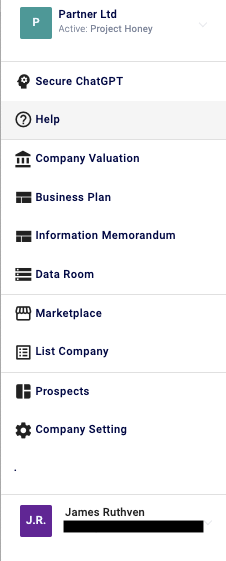

Login & Welcome Page

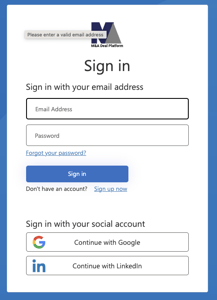

Login

Login Prompt

Enter your username and password or select a social account to login to the platform.

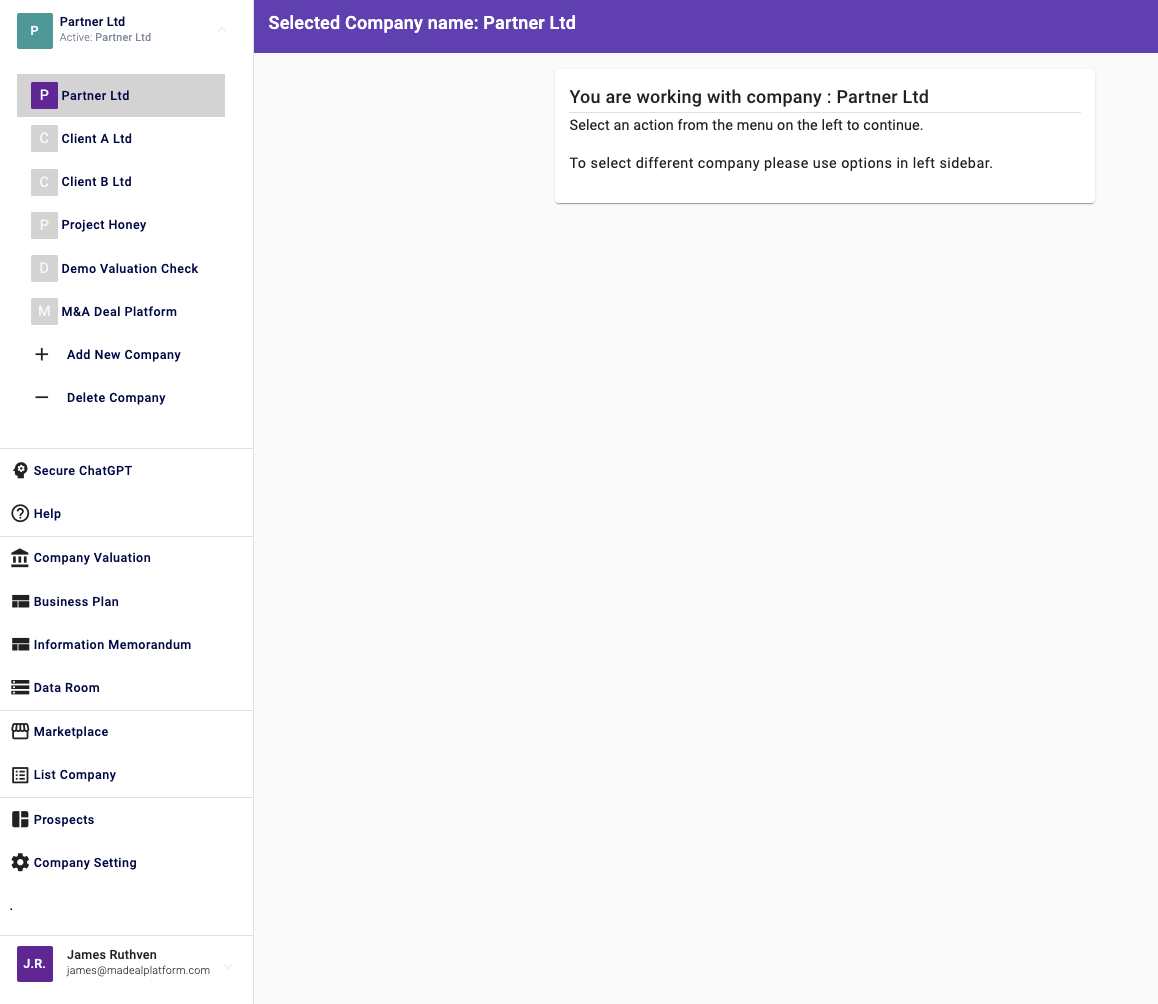

Welcome Screen

Once logged in the , the initial welcome screen is shown with the menu on the left.

Context

Your "context" or which company / client your are working in is shown at the top of the screen and the top left above the menu.

You can change the context by select the context name in the top left and then selecting the new context.

The top level context is your practice (Company), which contains your companies data. Below this are one or more of your clients.

The data in each context is kept separate, allowing you to create Valuation Reports, Business Plans and store data in Data Rooms for each client.

Add / Remove Client

To add a client, select the + button in the top left menu.

To remove a client select the - button in the top left menu.

Client Access

If you wish to give a client access to their own section in the platform, please email us, providing the client(s) name, company name in the platform and email address.

We will add them to the platform, providing them access to only their company context.

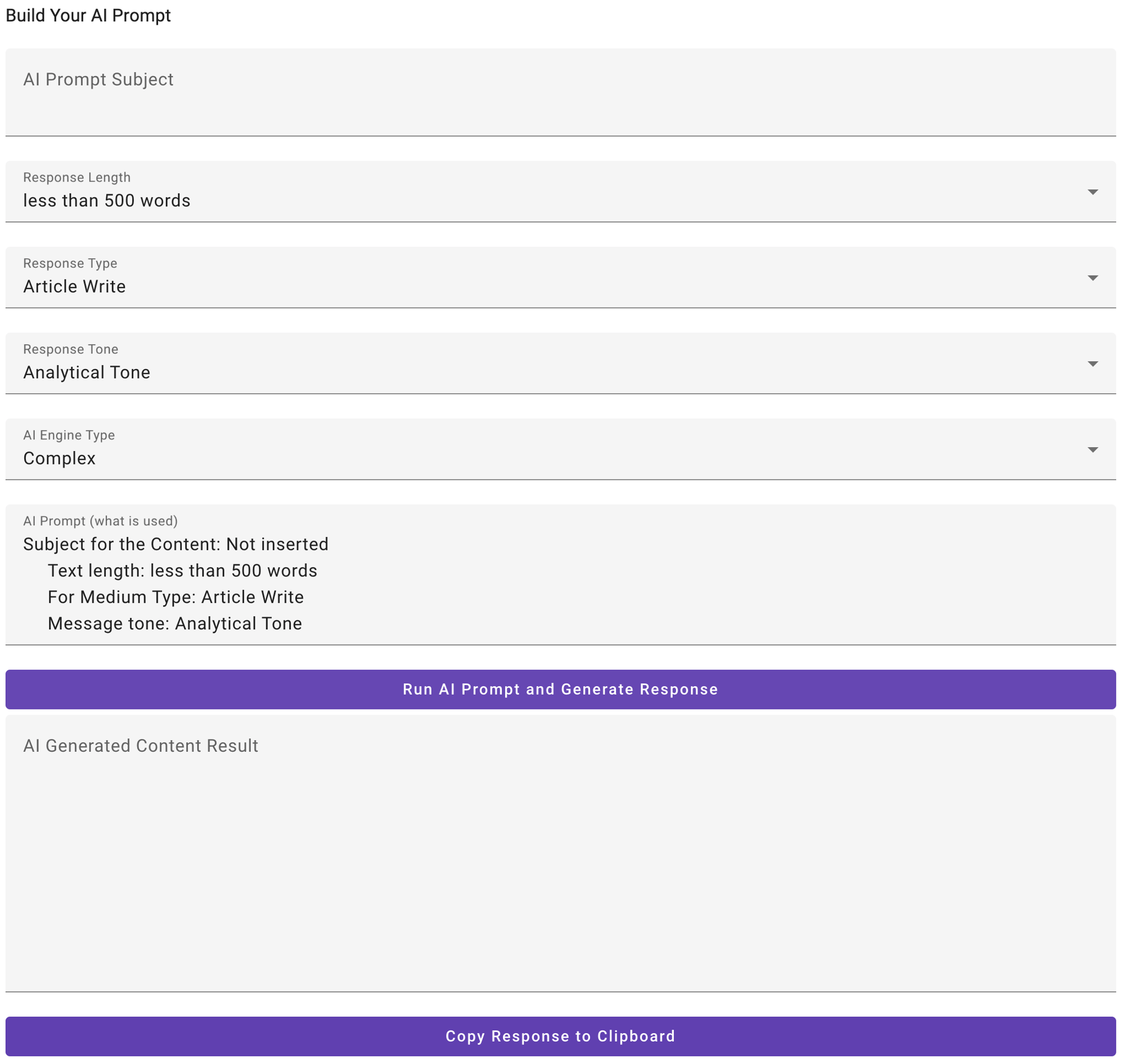

Secure ChatGPT

Build Your Prompt

AI Prompt Subject

Enter the subject matter, i.e. "Business Report for a Bank".

Response Length

Select the length of the response from 144 characters to less than 1,000 words.

Response Type

Select the type of content you want, i.e. an Article, a blog post, a case study etc.

Response Tone

Select the type of content you want, i.e. an Article, a blog post, a case study etc.

AI Engine Type

Select the AI Engine to use.

- Rapid > Fastest AI Engine but lowest complexity.

- Standard > Middle AI Engine.

- Complex > Most Powerful AI Engine but slowest to complete.

AI Prompt

The prompt (command) that is sent to the AI Engine. It can be edited directly before submission.

AI Generated Results

The results (returned) from the AI Engine. This can be copied and then pasted.

Company Valuation

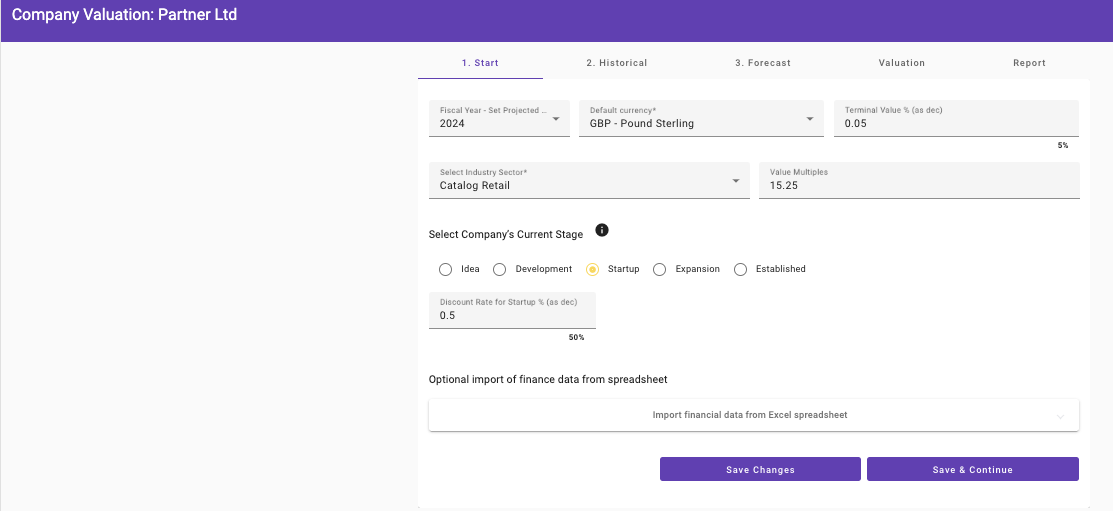

TAB 1: Start

Default Currency

Select the primary currency the company operates in.

The currency is used to set the Terminal Value. The Terminal Value represents the period beyond the forecasted 5 years, the growth of the company is linked to the inflation rate of the country where the business operates. This is widely considered as best practice due to the challenges in forecasting beyond 5 years.

Sector Enterprise

Select the primary sector the company operates in.

Business Current Growth Stage (Discount Rate)

Select the current business growth stage for the company. This directly changes the discount rate.

The discount rates used are linked to the lifecycle stage of the business and are inclusive of a liquidity discount for private companies.

A range of discount rates may be used when estimating the specific discount rate in view of the maturity stage of a company. For example, for a Startup business the discount rate applied is 89.00%.

Note that these rates are subject to change based on WACC (weighted average cost of capital) movements per stage of company across industries and other new research on private companies.

In our model we have used the following discount rates for the growth stages (please note we express in the form of 100%).

Idea (113.59%)

The Company has not been formed or only just formed with the founders having an idea for a product and / or service but not much more.

Development (111.47%)

The Company has begun developing its products and / or services, and the team is working to identify how the product fills a need in the market, also know as product / market fit.

Startup (89.12%)

The Company has typically been operating for more than 12 months, and you are testing the viability of the idea with trial or even paying customers. You are beginning to establish a customer base and market presence and have a better understanding of how your funds are sourced and allocated.

Expansion (49.6%)

The Company has typically been running for more than 24 months, and you have a good understanding of how your products and services meet customer needs as well as your business, specifically what drives profits. You will understand the current competitive landscape and market conditions and are now focused on strategies to expand market, revenue and potentially profit.

Established (48.75%)

The Company has typically been running for over 4 years and should now have stable Revenue and Operating. You will understand the current competitive landscape and market conditions and are now focused on strategies to expand market, revenue and potentially profit.

TAB 2 & 3: Historical & Forecast Financials

Financials are either Historical (past) or Forecast (future).

Consolidated Profit & Loss

Revenue

Revenue, often referred to as sales, is the income received from normal business operations and other business activities.

Direct Cost

Direct costs, also known as Costs of Goods Sold (COGS), are expenses that a company can easily connect to a specific "cost object," which may be a product, department or project. This can include software, equipment and raw materials. It can also include labor, assuming the labor is specific to the product, department or project.

Gross Profit

Gross profit is the profit a company makes after deducting the costs associated with making and selling its products, or the costs associated with providing its services. Gross profit will appear on a company's income statement and can be calculated by subtracting the cost of goods sold (COGS) from revenue (sales).

Indirect Cost

Indirect costs are usually business expenses that are used by multiple activities and as such can’t be directly assigned to a specific cost object like manufacturing of a product, service delivery etc. Rather, they are required to operate the business as a whole e.g. rent or management charges.

Operating Profit

A company's operating profit is its total earnings from core business functions for a given period and excludes the deduction of interest and taxes. It also excludes any profits earned from ancillary investments, such as earnings from other businesses that a company has a part interest in.

Add Back

An add back is an expense that will not be included in the buyer's future P&Ls for the company, that is, it is a one-off, non-recurring expense in the period. Understanding and applying add backs and other kinds of adjustments helps normalise a business's earnings on a go-forward basis. It can include a one-off customer bad debt or owner manager’s costs.

Directors Loans

A form of extracting monies from the company by a director that is not recorded as salary or dividend. Any monies owed to the company (overdrawn) or to the director (credit) is also recorded on the balance sheet at year end. Accurate records should be kept for tax purposes, but generally no corporation tax is paid on monies lent to the company.

Directors Salary

Add the Directors Salaries (if any).

Bad Debt

Bad debt is an expense that a business incurs once the repayment of credit previously extended to a customer is estimated to be uncollectible. Bad debt is a contingency that must be accounted for by all businesses that extend credit to customers, as there is always a risk that payment will not be received.

Other

Add other Add Backs here.

Subtotal

The application automatically calculates the total of Add Backs.

Add In

An “add in” is an expense that should be included in the buyer's future P&Ls for the company on a reasonable basis. Understanding and applying add ins and other kinds of adjustments helps normalise a business's earnings on a go-forward basis. For example, it can include the market salary of a manager to run the business operations once the owner-manager steps away. If the owner-manager has no current operational involvement, this estimate example is not required.

Management Charge

Market cost of a manager to replace the job function the owner currently carries out, if any.

Other

Add other Add Ins here.

Subtotal

The application automatically calculates the total of Add Backs.

EBITDA

Earnings before interest, taxes, depreciation and amortisation (EBITA) is an indicator of a company's profitability.

Adjusted EBIT

Earnings before interest and taxes (EBIT) is an indicator of a company's profitability. EBIT can be calculated as revenue minus expenses excluding tax and interest. EBIT is also referred to as operating earnings, operating profit, and profit before interest and taxes.

Depreciation

Depreciation represents how much of an asset's value has been used, to allocate the cost of a tangible or physical asset over its useful life.

Amortisation

Amortisation is paying off an amount owed over time by making planned, incremental payments of principal and interest.

Adjusted EBITDA

Adjusted EBITDA is a measure computed for a company that takes its earnings and adds back interest expenses, taxes, and depreciation charges, plus other adjustments to the metric. The application automatically calculates the Adjusted EBITDA.

Other

Interest

Any interest earned is recorded here.

Taxes

Any tax paid is recorded here.

Consolidated Balance Sheet

Current Assets

Current assets owned by the company.

Inventory (Stock)

Current Stock owned by the company.

Receivables (Debtors)

Debtors are invoices owed to you by customers

Prepayments

Prepayments are services paid for but not yet consumed.

Current Liabilities

Accruals

Accruals are services consumed but not yet paid or invoiced for.

Payables (Creditors)

Payables are sums owed to e.g. suppliers but not yet paid for.

Interest Payable

Interest payable are sums owed for borrowings but not yet paid for.

Deferred Revenue

Deferred Revenue are sums paid to the business for good or services that have not yet been delivered.

Summary Cashflow Statement

CapEx

Capital expenditures (CapEx) are funds used by a company to acquire, upgrade, and maintain physical assets such as property, plants, buildings, technology, or equipment. CapEx is often used to undertake new projects or investments by a company.

TAB 4: Valuation

This tab shows the valuation results including graphs.

1. Market Multiples

1.1 Adjusted EBITDA Multiples

2. Discounted Cash Flow (DCF)

2.1 Present Value Comparison

2.2 Valuation Elements

2.3 Data Summary

TAB 5: Report

This tab is used to build the valuation report and export it as a Word Document.

Confirm the Author, Company and Client details and before exporting the valuation report as a Word document.

Schedule a call with us if you wish to replace the Word Document with your own branded template.

AI Query Builder

The AI Query Builder is used to create the first draft of the commentary.

You can tune it by selecting.

Response Length

Select the length of the response from 144 characters to less than 1,000 words.

Response Type

Default is commentary create.

Otherwise select the type of content you want, i.e. an Article, a blog post, a case study etc.

Response Tone

Select the type of content you want, i.e. an Article, a blog post, a case study etc.

AI Engine Type

Select the AI Engine to use.

- Rapid > Fastest AI Engine but lowest complexity.

- Standard > Middle AI Engine.

- Complex > Most Powerful AI Engine but slowest to complete.

AI Prompt

The prompt (command) that is sent to the AI Engine. It can be edited directly before submission.

AI Generated Results

The results (returned) from the AI Engine. This can be copied and then pasted. It is automatically inserted it the downloaded Word Valuation Report.

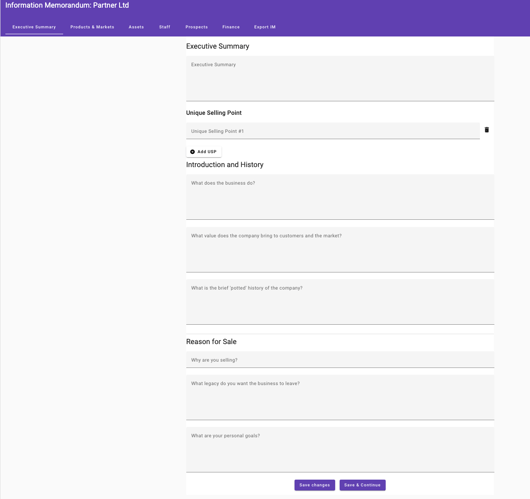

Information Memorandum

TAB 1: Executive Summary

Enter the details to complete the Executive Summary Section.

TAB 2: Products & Markets

Enter the details to complete the Products & Markets Section.

TAB 3: Assets

Enter the details to complete the Assets Section.

TAB 4: Staff

Enter the details to complete the Staff Section.

TAB 5: Prospects

Enter the details to complete the Prospects Section.

TAB 6: Finance

Enter the details to complete the Finance Section.

TAB 7: Export IM

Confirm the Author, Company and Client details and before exporting the IM as a Word document.

Schedule a call with us if you wish to replace the Word Document with your own branded template.

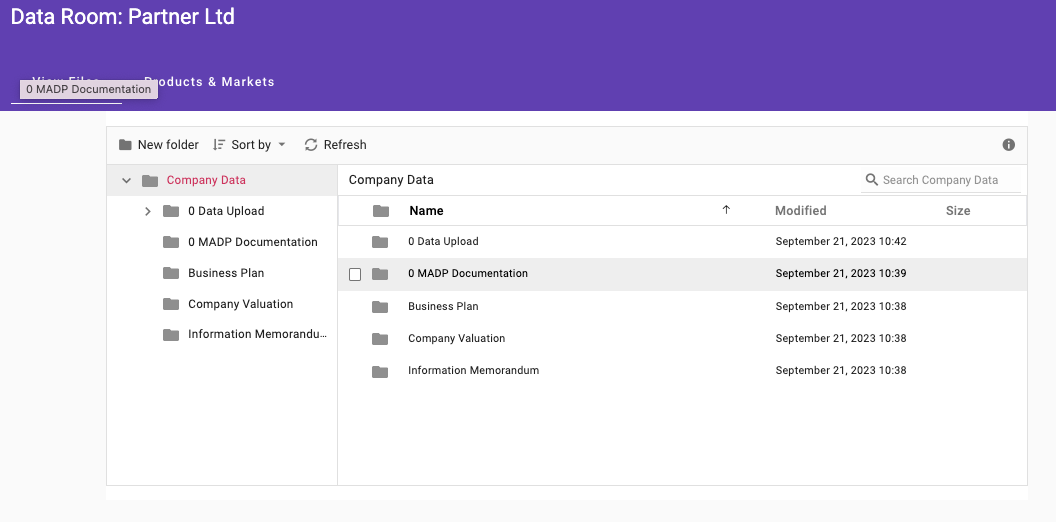

Data Room

TAB 1: View Files

Drag and Drop of Files on the Company into a separated secure file system for access by the practice.

Advisor Copilot (Release October 16th 2023)

The files in the data room are indexed and used to teach the Advisor Copilot for creating Business Plans, Information Memorandum and event the Secure Chat GPT.

TAB 2: Products & Markets

Allows you to upload Products & Markets information in a structured manner with additional text background information (meta data).

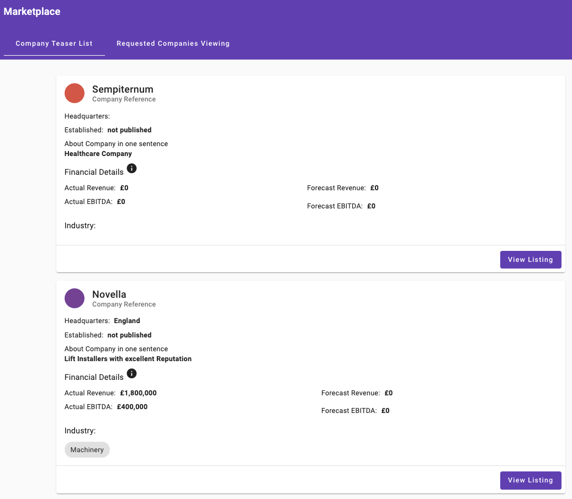

Marketplace

TAB 1: Company Teaser List

The current Marketplace Listings are shown. Here you can view any listings and request further information.

TAB 2: Requested Companies Viewing

The list of companies you have requested further information on.

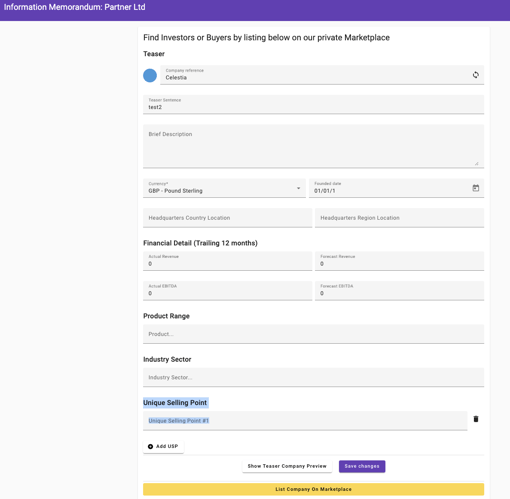

List Company

List a company for Sale

Create a teaser of the company for listing on the marketplace. We integrate the Information Memorandum and Mutual NDA signing.

Investment Listing Feature Roadmap Release Q1 2023

We will will be adding the capability to list a company looking for investment (Equity and / or Debit).

Lead Generation Valuation Application

Lead Generation Valuation Application

We can create your own practice branded version of the Valuation Application to promote on your website (embeded) or post on social media. Much better than a contact page!

Prospects

Prospects (CRM)

Any leads captured via the practices' Lead Generation Valuation Application are listed here for follow up by the practice.

Free Report

Click on the icon to see the leads completed valuation form and generate a indicative valuation report for them.

Delete Contact

Deletes the contact from the Prospect list/

Add Contact

Adds the contact as a company (context) within Practice platform - enabling creation of Valuation reports, Business Plans etc.

View Contact

View the contact details including email address, phone number etc. You can also change the status, sales cycle here.