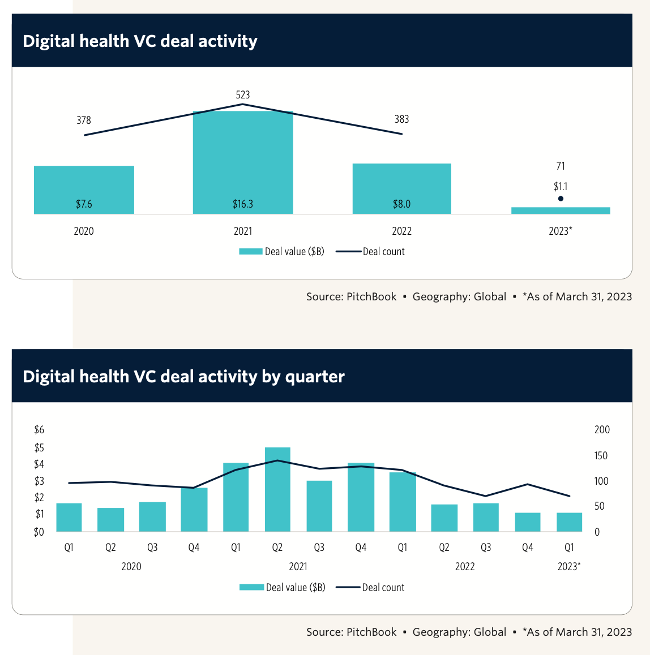

Venture capital (VC) investment in digital health experienced a significant drop from the second quarter of 2022 onwards, and this trend has persisted with VC funds disbursed per quarter generally ranging between $1 and $2 billion.

This pattern continued into Q1 2023, which saw an inflow of $1.1 billion, echoing the same funding level as Q4 2022. When compared to the corresponding quarter in 2022, the overall deal value saw a substantial dip, with Q1 2022 recording VC investments worth $3.5 billion in digital health.

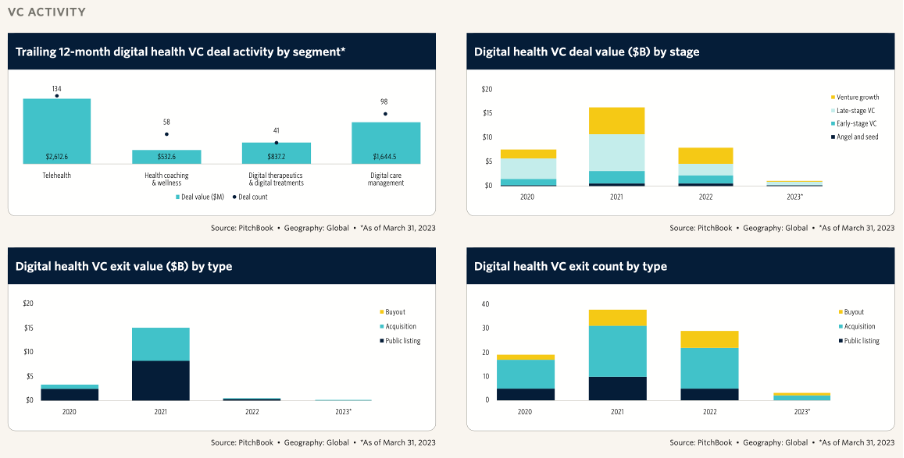

The first quarter of 2023 witnessed a total of 71 VC deals, reflecting a 42.3% decrease year-over-year, and the median deal size stood at $7.3 million. This is notably lower than the median for the entire year of 2022, which was $9.3 million. For the current year, early-stage investments have proven more resilient than those in later stages. This can be attributed to several factors, including potential uncertainty surrounding exit options for late-stage start-ups in the immediate future and the smaller fund requirements for early-stage deals. Given the existing market conditions, VC firms might find it easier to commit to smaller deals.

The most active investors in digital health for the quarter were CVS Health Ventures and Frist Cressey Ventures, both securing three deals each. Multiple investors including Octopus Ventures, What If Ventures, Fifty Years, BoxGroup, Inflect Health, Gaingels, and Samsung Venture Investment each completed two deals.

The quarter was virtually devoid of exits, with a meagre three exits reported. The most significant and prominent of these was the acquisition of Sequence by Weight Watchers for $132 million, amounting to a net value of $106 million after cash considerations.

Health Tech Company Highlights

Monogram Health

Monogram Health, a leading force in tech-driven kidney care, raised $375 million in a Series C funding round in Q1 2023, totalling $547 million in investments from industry heavyweights like Sequoia Capital, CVS, Cigna, and Humana.

Monogram provides innovative digital solutions to patients with chronic kidney diseases, offering remote monitoring, care coordination, and virtual nephrologist consultations. Its extensive network spans over 30 states and includes a diverse range of professionals.

As a value-based care operator, Monogram assumes risk for total care cost and is incentivised to provide superior care at lower costs. This approach is validated by patient data, recording a 28% home dialysis rate and an 18% readmission rate, both outperforming national averages.

Monogram's leadership includes CEO Michael Uchrin, CMO Dr. Shaminder Gupta, and CCO Dr. Amal Agarwal. Their board includes investment partners TPG and Heritage Group, and chair Dr. Bill Frist, whose experience strengthens the company's regulatory and governance understanding.

Despite competition from kidney care startups like Somatus, Cricket Health, and Strive Health, as well as traditional giants like Fresenius Medical Care and DaVita, Monogram distinguishes itself as a care coordinator and tech platform. Recent market entry Mozarc Medical and the anticipated standalone competitor from Baxter's kidney care operations pose additional competition.

With over 35 million adults in the US affected by chronic kidney disease, the market holds promise due to a growing patient base and the expected rise in at-home dialysis. This increase is likely to benefit tech-focused startups like Monogram that prioritise cost-effective care. Despite the global challenges of dialysis reimbursement, the demand for kidney failure treatment is expected to double by 2030, providing ample opportunities for tech-driven kidney care providers.

Papa

Papa, a marketplace for adults seeking health and care services, pairs members with vetted care companions known as Papa Pals. The services extend beyond traditional health provisions, including health appointment coordination, nursing support, dietitians, and even social workers. Funded by prominent investors like Canaan Partners, SoftBank Vision Fund 2, and Comcast Ventures, Papa has become a significant digital health unicorn. In 2021, the company's valuation hit $1.4 billion following a $150 million Series D round led by SoftBank Investment Advisers.

Founded in 2017 by CEO Andrew Parker and COO Alfredo Vaamonde, Papa has a strong leadership team with industry veterans like CFO Dani Bchara, CTO Craig Ogg, and Chief Revenue Officer Charles Hectors. The company, inspired by Parker's own grandfather's care needs, maintains a robust network of members and caregivers and is well-positioned for another funding round in the near future, likely backed primarily by existing investors.

Papa competes with startups like Duos, Uniper Care, and Pyx Health that aim to address challenges faced by older populations. However, Papa's unique business model and larger caregiver network set it apart. As social determinants of health increasingly gain recognition, Papa's comprehensive caregiving service is poised for further growth. The company can help millions of older adults who face unmet social needs, providing them with health and care services that tackle these issues. In addition, Papa offers a valuable solution for families facing the financial and physical strains of caregiving, offering third-party support that can provide peace of mind.

Headspace

Headspace Health, an integrated mental health and wellness startup, valued at $3.0 billion after merging with Ginger, an on-demand virtual mental health provider, in 2021. The unified company offers services from mindfulness programs to teletherapy. It expanded its offerings through acquisitions of AI mental health startup Sayana and Shine, a provider of mental health services for people of color. In November 2022, a unified platform combining Headspace's and Ginger’s services was announced, followed by an international expansion starting with the UK in 2023.

While retaining its DTC platform, Headspace targets the enterprise market with its enterprise solutions, Headspace for Work and Ginger for Employers, aiming to provide a comprehensive platform for employee mental health.

Founded by Andy Puddicombe and Richard Pierson in 2010, Headspace’s current CEO is Russell Glass, previously CEO at Ginger, who took over following the merger. The executive team includes Christine Hsu Evans (CMO and Strategy Officer), Karan Singh (COO), and Alex Boisvert (CTO), all former Ginger executives. The diverse board comprises representatives from investors like Blackstone and Advance Venture Partners and independent directors.

Competitors in the teletherapy and mindfulness spaces include Calm, Breethe, and Meditopia, but Headspace outreaches with more than 100 million potential users through its integrated consumer and enterprise brands. It also stands out by offering integrated meditation and telehealth service, a service unavailable to competitors like Calm. Teletherapy-focused companies like Talkspace, Teladoc, and Cerebral are potential competitors due to Ginger’s telehealth offerings.

Headspace, with its comprehensive mental health services and global ambitions, is expected to pursue an IPO in the next few years. Despite challenges like scrutiny over patient data usage, strong competition, and cost-cutting from its customer base, the post-pandemic landscape is likely to favour virtual mental health providers, positioning Headspace as a promising contender in the digital health market.