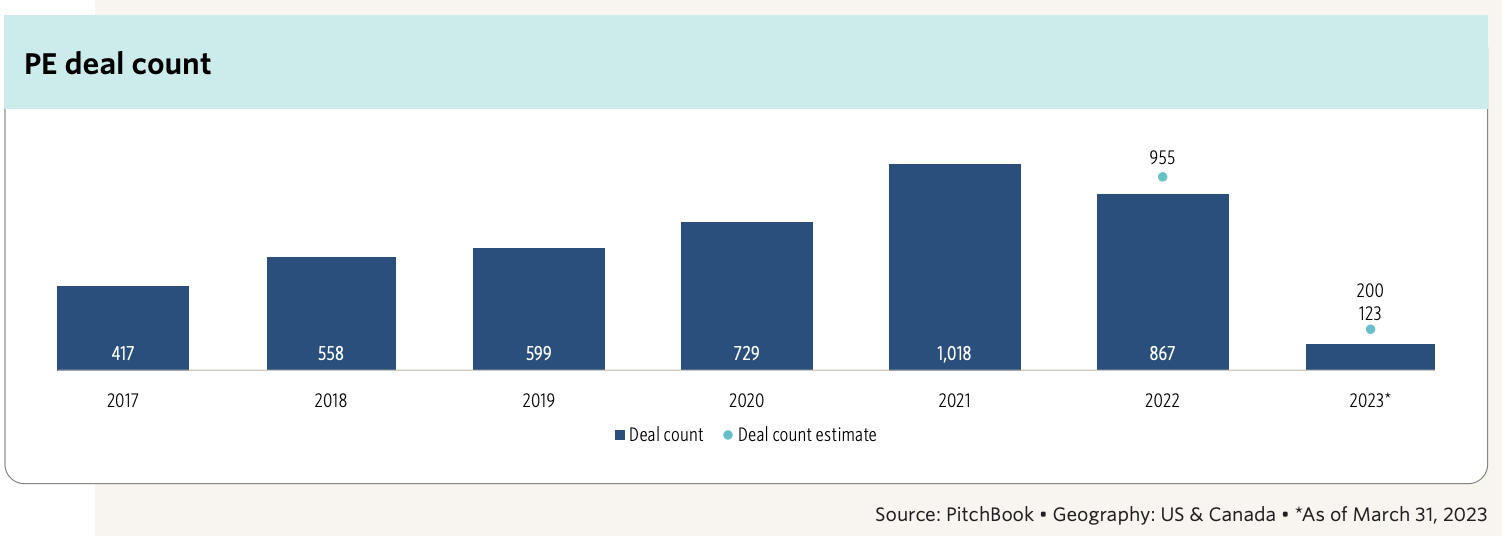

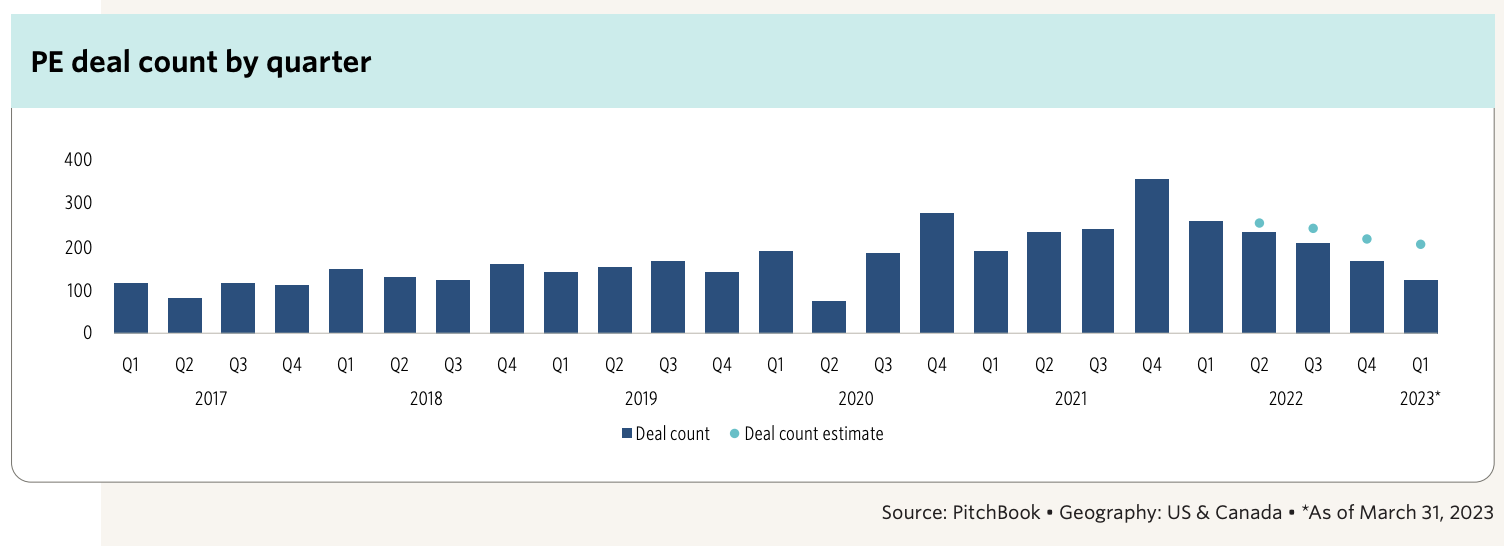

Private Equity (PE) investment in healthcare services fell for the fifth consecutive quarter in Q1 2023 with 200 deals, down 21.5% from the 2021 pace but 20.4% higher than the average in 2018-2019.

The industry is adjusting to higher interest rates, lower multiples, and slower deal processes. Lenders are providing less leverage and multiples are generally lower than in 2021, largely due to reduced leverage.

Despite the collapse of Silicon Valley Bank, deals can still be done, with significant dry powder available from private credit fundraising.

PE sponsors are deploying capital through minority equity injections and mezzanine financing to fuel growth, with notable deals including HOPCo and Keplr Vision in Q1.

Additionally, investors are pursuing buyouts with groups that have not yet taken institutional funding. However, there is potential risk in consumer discretionary spending if the US enters a moderate-to-deep recession.

There were only two platform buyouts announced or completed in the quarter, including Kohlberg & Company's acquisition of United Digestive and Eads Bridge Holdings' buy of Stokes Counselling Services. Notably, General Atlantic's $2.1 billion sale of OneOncology to TPG and AmerisourceBergen was announced after Q1.

Some heavily leveraged companies are struggling with debt service and experiencing slower growth, with the healthcare sector showing a high distress ratio. This is due to persistent wage inflation, over-leveraging platforms to fund rapid growth, and staffing shortages in healthcare services. Leveraging technology to improve workforce efficiency and investing in staff culture and development have become crucial for healthcare services investing.

PE investors are also seeing interesting carveout opportunities as hospitals and health systems navigate ongoing margin pressure. These include Lehigh Valley Health Network's sale of its occupational medicine service line to Concentra, and ProMedica's sale of hospice and home care assets to Gentiva for $710.0 million.

In terms of the deal outlook for the rest of 2023, there is little expectation of an imminent rebound in platform deal activity.

However, larger deals at the end of Q1 may signal a potential shift. Given the current economic climate, buyers and sellers may need to adjust their valuation expectations, and more distress-driven deals may occur. Overall, a flat-to-slightly-up Q2 and second half of 2023 are expected.