Guide to Business Advisory

5-Second Summary

- Business Advisory is an important tool to support owner managers decision making.

- Business Advisory is not just a one off event, it should become part of your regular business process.

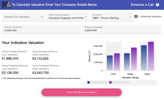

- You can get a quick Business Advisory Report using our Business Advisory Application.

Why receive Business Advice?

Common reasons given for receiving business advice report include;

Navigating Challenges

Business is full of challenges and uncertainties. Expert advice can help navigate these hurdles, providing strategies to manage risk, handle crises, and avoid potential pitfalls.

Planning and Strategy

An outside perspective can bring new ideas or help reassess existing strategies. It might be easier for an outsider to identify areas for improvement or opportunities for growth. Good business advice can help with business planning, setting goals, and devising strategies to achieve them.

Expert Knowledge

Business advisors often have expertise in areas that you might not, such as finance, marketing, or law. They can help ensure your business is compliant with relevant regulations and is utilising best practices in different areas.

Saving Time and Money:

Mistakes can be costly. Business advice can help avoid them, saving time and potentially a lot of money. An advisor can help you understand where to invest your resources for the best return.

Networking

Advisors often have extensive networks and can provide valuable connections. This could lead to new customers, business partners, or opportunities.

Keeping Up-to-date

The business world changes rapidly. A good advisor stays up-to-date with the latest trends, technologies, and market shifts and can guide your business to stay relevant and competitive.

Increasing Confidence

Having expert advice can increase your confidence in decision-making. You'll know you're making well-informed choices, which can reduce stress and allow you to focus on running your business.

Objectivity

Sometimes being too close to the business can lead to blind spots. An external advisor provides an objective viewpoint, highlighting issues or opportunities you might have missed.

How do you find a Good Business Advisor?

Finding a good business advisor involves several steps. Here are some tips to help you through this process:

Identify Your Needs

Understand what you're looking for in an advisor. Are you seeking specific expertise, such as marketing or financial advice? Or do you need a generalist who can guide you on various aspects of your business? Knowing what you need will help narrow down potential advisors.

Ask your Accountant

Many accountants provide some forms of business advisory, especially around financial management and as they already know your business, they can be a great starting point for you into the world of Business Advisory.

Look in Your Network

Start by asking for recommendations from people within your network, including business associates, peers, or mentors. This can often lead you to trusted advisors.

Research Credentials

Make sure any potential advisor has the right credentials and experience. Look at their track record and ask for references. Check their qualifications and professional memberships.

Interview Prospective Advisors

This step is crucial. Ask about their experience with businesses similar to yours, how they've helped other clients, how they communicate, what their values are, and how they charge for their services.

Check Compatibility

A good relationship with your advisor is essential. Make sure you feel comfortable with them and that they understand your business and your goals. They should be someone you can trust and rely on.

Clarity About Fees

Before you engage an advisor, be clear about their fees and what you're getting in return. Make sure you understand the billing arrangements.

Continuous Evaluation

Once you've hired an advisor, regularly assess the value they're providing. Are they helping you reach your goals? Are they responsive and communicative? Don't be afraid to change advisors if your needs are not being met.

What is Good / General Business Advice

Have a Clear Vision

Before starting any business, it's important to know what you're aiming for. Define what success looks like for your business and set specific, measurable, achievable, relevant, and time-bound (SMART) goals.

Conduct Market Research

Understand your market thoroughly. Know who your customers are, what they want, and how you can meet their needs better than your competitors.

Provide Exceptional Service

Customer service is key to retention and word-of-mouth referrals. Go the extra mile to make sure your customers are satisfied.

Adapt to Change

The business environment is constantly changing. Be open to change and adapt your business strategies as needed. Keep an eye on market trends and adjust your business accordingly.

Manage Cash Flow Efficiently

Cash flow is the lifeblood of any business. Make sure you have a good handle on your expenses and revenue. Keep enough reserves to manage any unexpected downturns or opportunities.

Invest in People

Your team is your most important asset. Hire people who are not just qualified, but also align with your business's culture and values. Invest in their development and well-being.

Use Technology

Digital technology can automate routine tasks, improve efficiency, reduce costs, and provide better service to your customers. Embrace it.

Focus on Networking

Building a strong network can open doors to new opportunities, partnerships, and insights. Attend industry events, join business forums, and engage on social media.

Have a Unique Selling Proposition (USP)

Your USP is what makes your product or service different from everyone else's. It's the reason why customers should choose you over your competitors. Make sure you have a strong and clear USP.

Continually Learn and Improve

The business world is constantly evolving, and the most successful entrepreneurs are those who make a commitment to continuous learning and improvement.

What does a typical Business Advisory Engagement Process?

Initial Meeting/Consultation

This is where the business and the advisor meet to discuss the business's needs, goals, and challenges. The advisor will typically ask questions to understand the business better and to assess how they can provide value.

Proposal

Based on the initial consultation, the advisor will create a proposal outlining the scope of the engagement, including the services to be provided, timelines, and costs. The proposal may also identify key deliverables and milestones.

Engagement Letter/Contract

If the business agrees to the proposal, the next step is typically an engagement letter or contract. This document formalises the relationship and outlines the responsibilities of both parties, confidentiality obligations, fees, and termination provisions.

Assessment

The advisor will carry out a more in-depth assessment of the business. This might involve reviewing financial documents, meeting with key personnel, analysing business processes, and more.

Strategy Development

Based on the assessment, the advisor will develop a strategy or plan. This will outline the actions the business needs to take to address its challenges and meet its goals.

Implementation

The business then starts implementing the plan, often with the advisor's ongoing support. The advisor might assist with change management, provide training, or help set up new systems or processes.

Review and Adjust

The advisor will monitor progress and help review results against the planned goals. Depending on the outcomes, the plan may need to be adjusted.

Final Evaluation

At the end of the engagement, there is typically a final evaluation to assess the overall success of the project and identify any lessons learned.

Can a business advisor help with digital transformation?

Absolutely, a business advisor can play a pivotal role in assisting with the digital transformation process in the following areas.

Strategy Development

An advisor can help develop a comprehensive digital transformation strategy that aligns with the business's goals. This includes identifying what digital technologies would have the most impact on the business, setting clear objectives, and creating a roadmap for implementation.

Process Optimization

Digital transformation often involves rethinking and optimising business processes. Advisors can bring an outside perspective, helping to identify inefficiencies and suggesting how digital tools can improve operations.

Technology Selection

There are countless digital tools and technologies available, and it can be difficult to know which are the best fit for their needs. An advisor can guide the selection process, ensuring the business invests in technologies that offer the most benefit.

Change Management

Digital transformation often requires significant changes, not just in terms of technology, but also in terms of business culture and ways of working. Advisors can guide the company through this change, helping to manage resistance, training staff, and ensuring everyone understands the benefits of the transformation.

Risk Management

Implementing new technologies also introduces new risks. An advisor can help identify these risks and develop strategies to mitigate them.

Measurement and Analysis

An advisor can help set key performance indicators (KPIs) and measure the success of the digital transformation. They can analyse the results, suggest adjustments as needed, and ensure the transformation is delivering the expected benefits.

How can a business advisory service assist in risk management for SMEs?

Business advisory services can play a crucial role in risk management for small and medium-sized enterprises (SMEs). Here's how:

Risk Identification

Advisors can help businesses identify potential risks, including operational risks, financial risks, market risks, regulatory risks, and cyber risks. By conducting a thorough risk assessment, advisors can uncover vulnerabilities that may not be evident to the business owners.

Risk Evaluation

Once risks are identified, business advisors can assist in evaluating these risks, determining their potential impact, and the likelihood of them occurring. This helps prioritize risks and focus on those that could have the most significant impact on the business.

Risk Mitigation Strategies

After identifying and evaluating risks, business advisors can develop strategies to mitigate these risks. This can involve creating contingency plans, implementing risk transfer mechanisms (like insurance), improving processes and controls, or investing in security measures.

Compliance

Regulations vary by industry, and non-compliance can lead to hefty fines and repetitional damage. Advisors can ensure that SMEs are aware of the regulations they need to comply with and help them implement the necessary procedures and controls.

Training

Advisors can provide training to the business owner and employees on risk management best practices, helping to foster a risk-aware culture within the organisation.

Monitoring and Review

Risk management is not a one-time event. It requires ongoing monitoring and review. Business advisors can help SMEs implement risk monitoring tools and processes and assist in periodically reviewing and updating the risk management strategy as the business environment changes.

Crisis Management

Should a risk event occur, business advisors can help manage the crisis, minimising damage, and ensuring a quicker recovery.