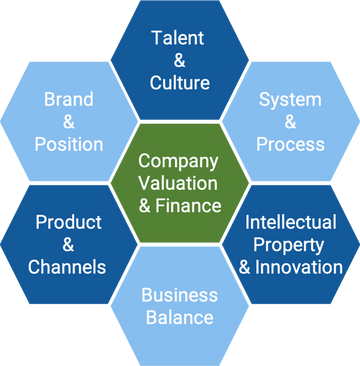

The process of business valuation can be complex, and it's important to take a consultative approach to ensure accuracy and relevance. In this blog post, we'll explore key factors to consider when valuing your business and offer some guidance to help you unlock its true potential.

While you read our article below, our free company valuation app can help kick-start your understanding of your company's valuation.

Identifying the Purpose of the Valuation

Before diving into the valuation process, it's essential to identify the purpose behind it. Are you looking to sell your business, secure funding, or assess its performance? The purpose will influence the methods and factors considered during the valuation, ensuring that the final result meets your specific needs.

Choosing the Right Valuation Method

There are various valuation methods available, each with its advantages and drawbacks. It's essential to choose the one that best aligns with your business goals and industry.

- Asset-based approach: This method focuses on the net asset value of your company, considering both tangible and intangible assets. It's most appropriate for businesses with significant physical assets or where liquidation is a possibility.

- Income-based approach: This method estimates the value of your business based on its ability to generate future cash flows or earnings. It's particularly suitable for companies with stable and predictable income streams.

- Market-based approach: This method compares your business to similar businesses in the market, using metrics such as revenue, earnings, or industry-specific ratios. It's most applicable for businesses operating in well-established industries with a sufficient number of comparable transactions.

Considering Industry-Specific Factors

Each industry has unique characteristics that may affect your company's value. Factors such as market trends, growth potential, and regulatory environment can all play a role in your valuation. Consult with industry experts to ensure you're taking these factors into account and positioning your business accurately within its market context.

The Importance of Accurate Financial Data

A key component of any business valuation is the accuracy of financial data. Ensure that your financial statements are up-to-date, accurate, and prepared according to relevant accounting standards. This will not only provide a solid foundation for your valuation but also improve your credibility with potential investors or buyers.

Adjusting for Non-Recurring or Non-Operating Items

When valuing your business, it's crucial to make adjustments for non-recurring or non-operating items, such as one-time expenses, gains, or losses. These adjustments will provide a clearer picture of your company's true financial performance and help you arrive at a more accurate valuation.

Engaging a Professional Valuation Expert

While it's possible to conduct a business valuation independently, enlisting the help of a professional valuation expert can provide invaluable insights and guidance. An expert will not only ensure that your valuation is accurate and reliable but also help you identify opportunities for growth and improvement.

Remember that business valuation is an ongoing process, and it's essential to regularly reassess your company's value to stay informed and agile in an ever-changing market landscape.