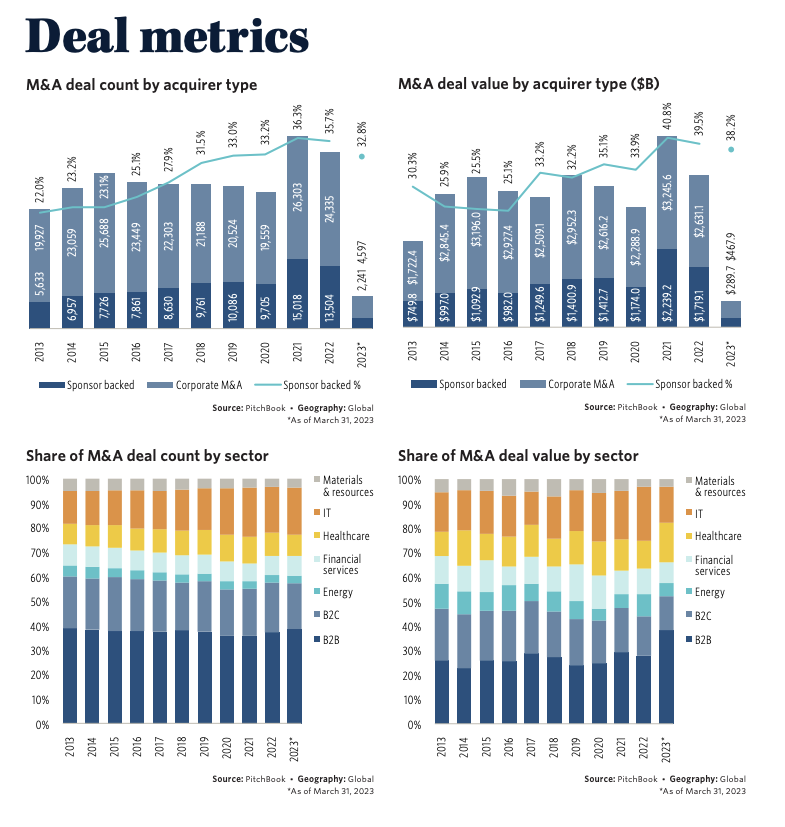

Global M&A activity faltered in Q1 2023, with deal value declining 32.2% from the Q4 2021 peak. The harsh macroeconomic backdrop and a near crisis in banking contributed to this downturn. However, dealmakers still managed to achieve nearly $1 trillion in deal value.

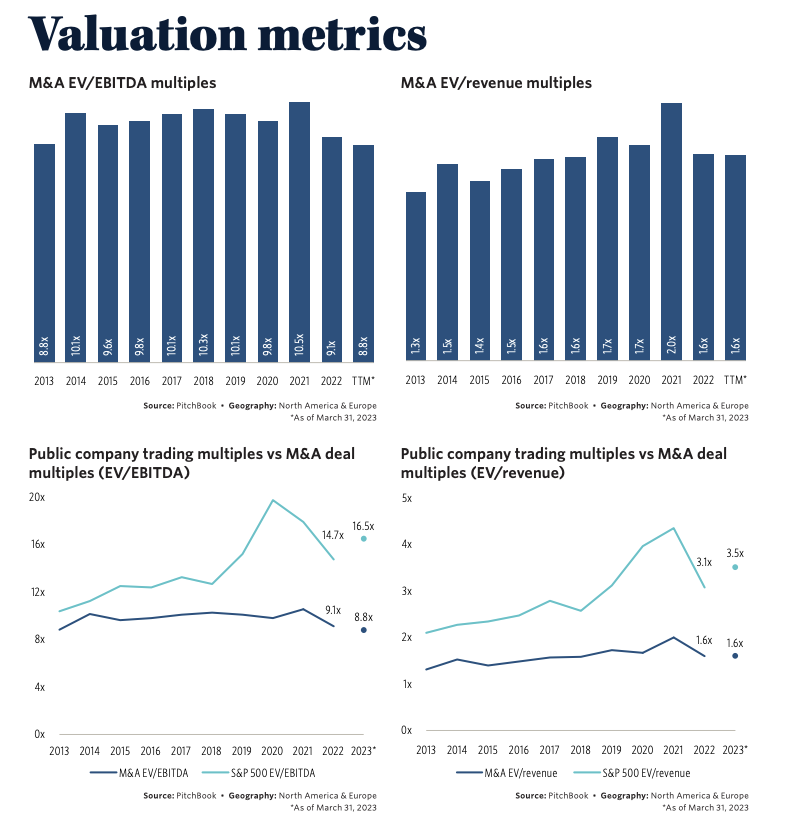

Heavily discounted prices, particularly in the sub-$100 million range, supported M&A activity. This segment had a median enterprise value (EV) to revenue multiple of 1.1x over the last 12 months, a 31.3% discount compared to the overall global M&A median of 1.6x.

As private equity (PE) firms hesitated to sell portfolio companies at lower prices, founder-owned businesses stepped in, accounting for 85.3% of M&A transactions in 2023, an all-time high.

Founder-owned businesses and sub-$100 million companies exerted downward pressure on median purchase price multiples. PE deal multiples, which remained steady in 2021 and 2022, finally collapsed in 2023 to a median of 1.7x revenue.

Lower valuations helped maintain deal flow and prevented an even steeper decline. Q1 2023 deal value dropped by 10%, with quarterly deal flow now on par with pre-COVID-19 levels, up 37.9% by count. While PE buyers appear to pay higher purchase price multiples than corporate buyers, they actually pay less for larger targets, particularly on an EBITDA basis. PE buyers paid a median multiple of 2.0x for deals below $1 billion, compared to 1.3x for corporate-led deals in the middle market.

Cross-border M&A activity has slowed significantly in 2023, with the US dollar's decline by more than 10% reducing purchasing power for North American acquirers. As a result, cross-border activity between North America and Europe has slowed by 38.4% and 45.7%, respectively, causing the net flow of M&A capital to Europe to evaporate.

The near-banking-crisis in the US and Europe did not disrupt the M&A market but changed the outlook on interest rates, with markets expecting easier monetary policies before year-end. However, turbulence in the sector put downward pressure on leveraged loans that many big banks seek to offload, slowing the reopening of the bank-led syndicated loan market that had been gaining momentum.

Use your own values using our updated valuation application.

Use your own values using our updated valuation application.