Grow Revenue, Retain Clients and Develop Expertise by offering Corporate Finance

For any accountancy practice part of your strategy will be geared towards client retention, whereby through regular, constructive interaction they are assured of receiving a high quality, accurate and customised service.

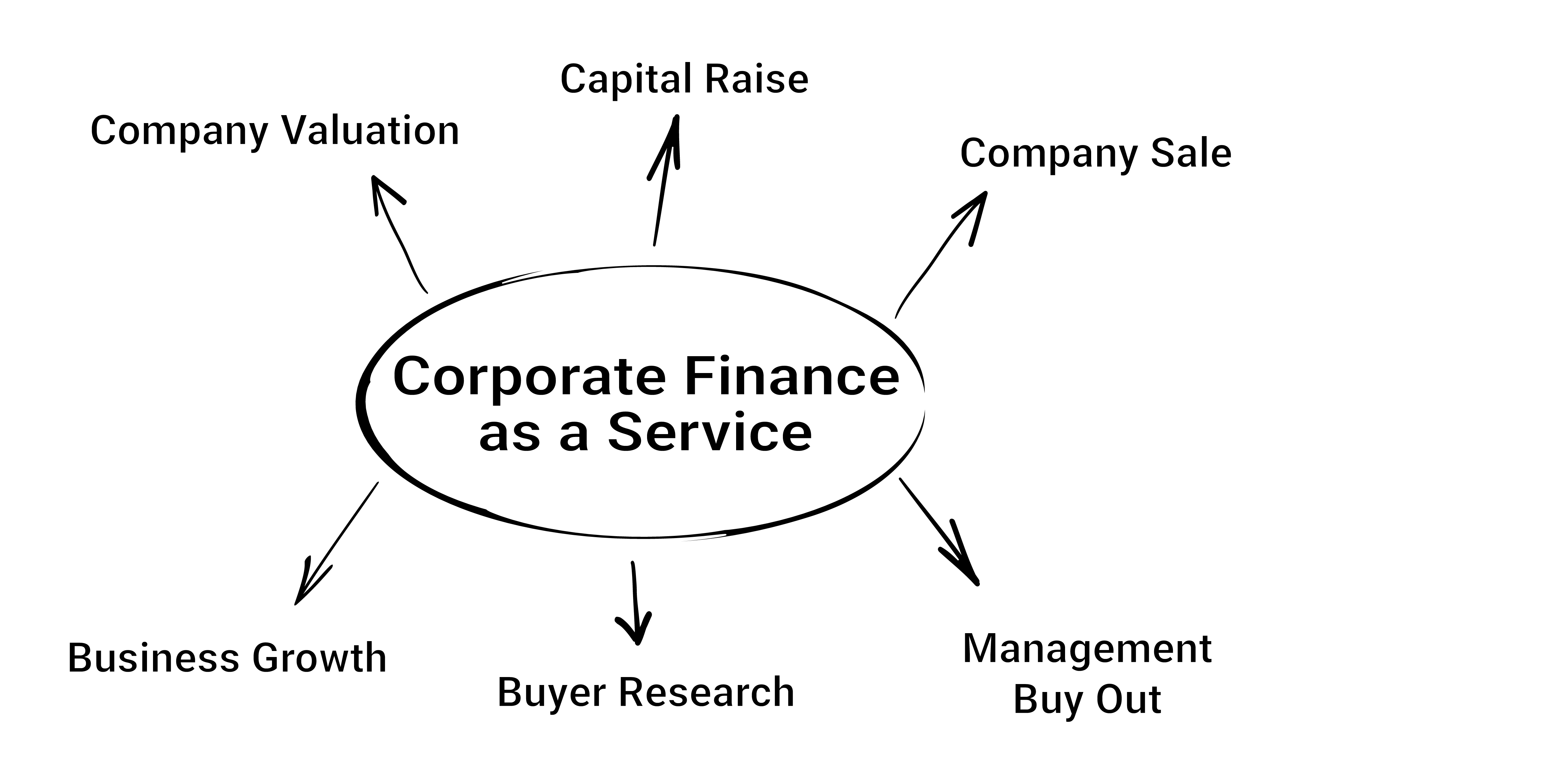

From this perspective, corporate finance services can provide an additional and essential touch point with your clients, giving them vital insights on how to scale their business and raise capital, as well as guide them through the potential pitfalls towards a successful exit and / or float. These elements are critical to their business success and therefore differentiated and highly valued by clients.

Why Corporate Finance?

In our experience of building in-house corporate finance services and working in partnership with accountants, we have found that the most common reasons for a practice to offer corporate finance services are:

- A desire to support clients through some of the most important phases of their company’s journey.

- Partners / staff are keen to develop new skills and knowledge in corporate finance, resulting in enhanced workplace motivation and staff retention.

- To increase revenue per customer.

- To stop losing clients to competitors who offer corporate finance services.

At M&A Deal Platform we support accountants on their corporate finance journey, from enabling them to offer corporate finance jointly with our team, to a complete corporate finance white label solution with an embedded corporate finance team, through to supporting the development of their own in-house corporate finance department.

Learn More about our Corporate Finance- Deliver more value to your clients – provide Company Valuation Reports

- What is Corporate Finance as a Service?

Our process of enabling corporate finance within an accountancy practice is built upon decades of corporate finance experience. Book a call with us to learn more about how we can help you offer Corporate Finance Services to your clients within 30-days.