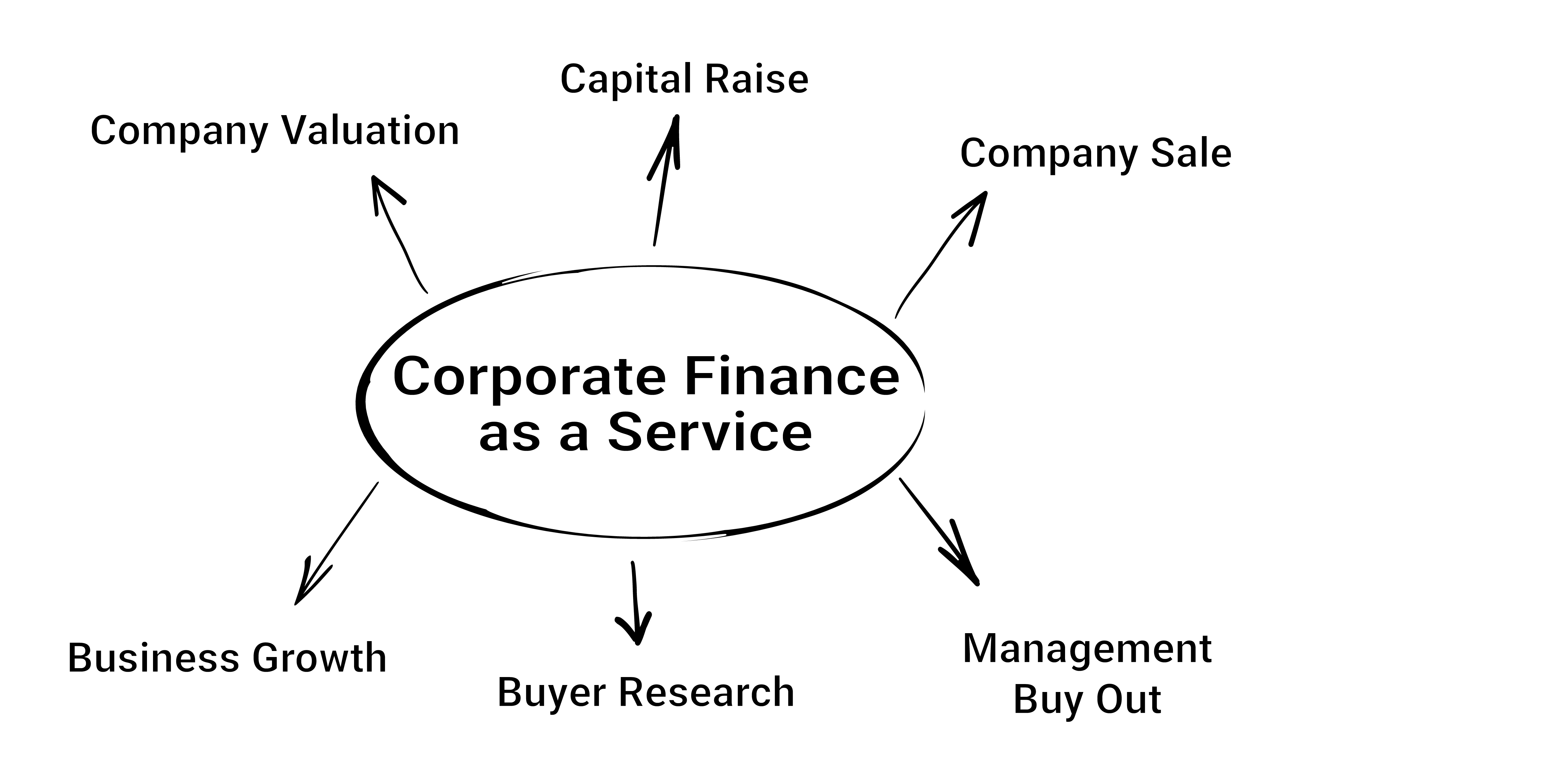

In order for an accountant to sell a company valuation report, first it's important to understand why a client might want a valuation.

Common reasons given for a valuation report include.

- to set an asking price for a business sale

- construct an offer to buy a business

- get a bank loan

- write a buy-sell agreement

- settle a disagreement with a partner

- or defend your business value in a legal dispute.

However, at M&A Deal Platform we believe it’s a single word - intelligence.

Our valuation application produces Company Valuation Report that are useful management tools by themselves, and that support your client management decision making, including answering questions like.

- Are there potential market concerns with an investment?

- Is an investment viable for the business?

- Is an investment 'good'?

- Does a new contract that grows top line sales also have a positive impact on cash overtime?

And therefore, it helps answer a fundamental question - does "X" grow the value of the business?

Once you understand what intelligence your client is after - you will find the valuation report sell themselves!