Selling a business for most business owners is a once in a lifetime experience that at times may seem an impossibly complex and risky endeavour.

From our experience, business owners considering selling their business are often confused by the process, are unsure who to trust.

In response to this and to speed up the process we have developed our Express Exit™ and Precision Exit™ frameworks , that prepares both the business owner and the company to dramatically increase the chance of a quick, successful deal with the maximum valuation.

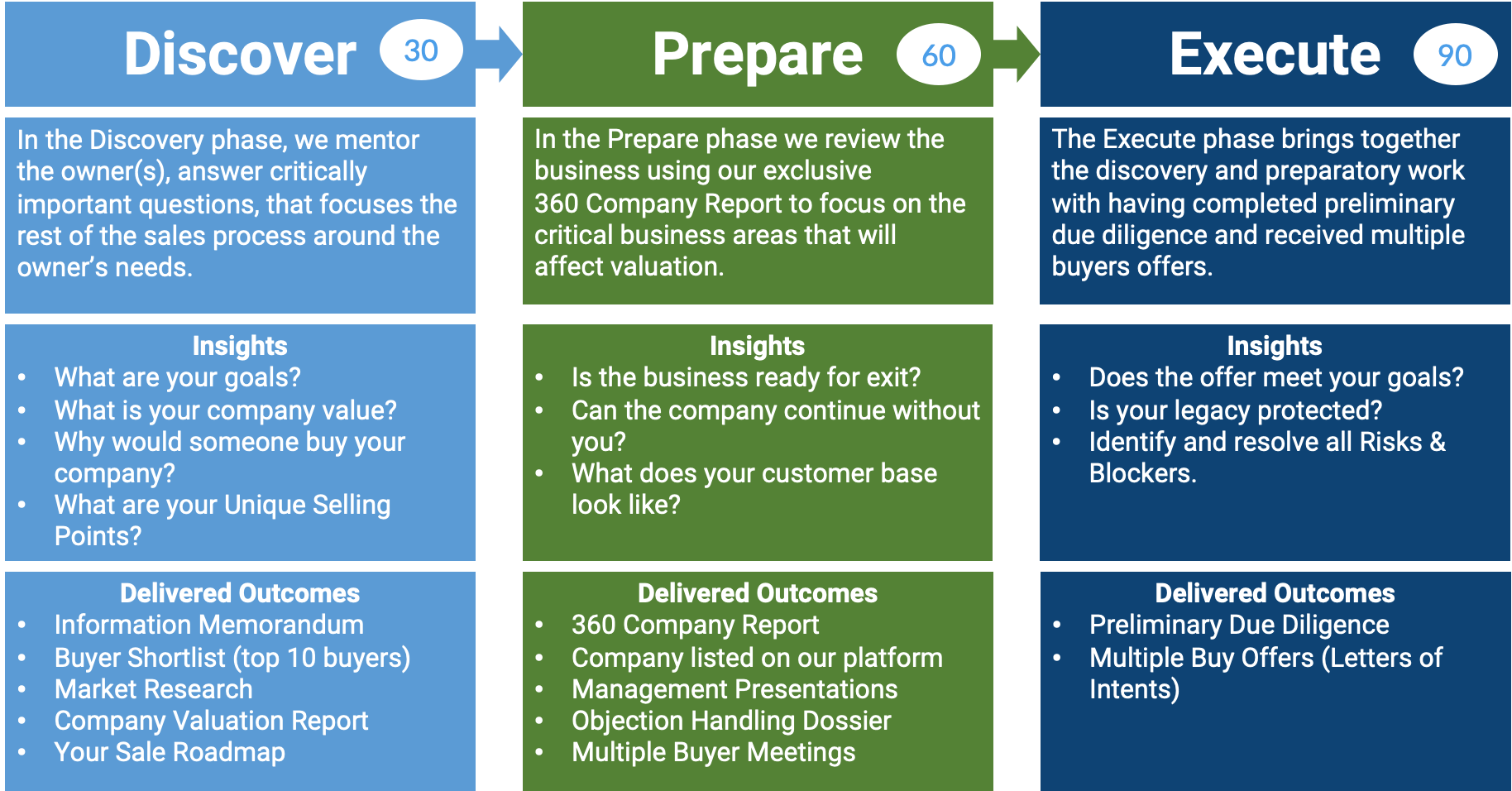

Our framework splits the process into three phases, covering the important starting 30, 60 and 90 days. Each phase has a clearly defined scope with outputs and progress is tracked within our digital M&A platform as a project with tasks and actions. There are regular meetings between owners and the M&A Deal Platform team to discuss progress and answer any questions.

Discovery Phase - Days 1 to 30

In the discovery phase, we mentor the owner(s) and help them answer the critically important questions, that will ground the rest of the sales process around the owner’s needs. Some examples of the questions include.

What are the owners’ goals?

An owner needs to be clear on what they are looking to achieve from an exit and by when. Are they trying to make a quick change, or are they comfortable with a longer transition period that may provide a higher valuation but with a probable caveat of deferred element of when cash can be extracted?

What is the company fair valuation?

A common problem is that an unrealistic presale valuation for the company can distort an owner’s expectations versus the market reality and distract from the larger picture. A key outcome of the process is to prepare the company for the typical and business specific risks, then to market the company to correct type of buyer to maximise valuation. We use our 360 Company Valuation Report™. See our Business Valuation guide to learn more about business valuation in general.

Prepare Phase - Days 31 to 59

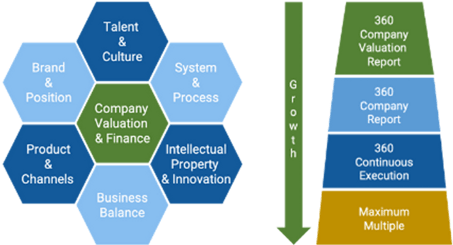

In the Prepare phase, we look at business itself, using our 360 Company Report™ to focus on seven critical business areas, that captures gaps and issues within the company that will ultimately affect its valuation.

In the Prepare phase, we look at business itself, using our 360 Company Report™ as a lens to focus on seven critical business areas, and capture gaps and issues with the company that may affect its valuation and fix them.

Company Valuation & Finance

The company valuation is usually driven by industry comparable transactions as a basis and applying a discount for specific risks. A strategic premium on valuation can be achieved by an honest review into the business areas below as well as understanding the strengths of the business within those areas.

Talent Culture

A buyer wants to make a smooth transition, and knowing they are “buying” a strong management team is key contributor to a high valuation, quick sale and for further growth.

System & Processes

A company with well implemented systems and processes means a robust platform to achieve operational effectiveness, whereby the buyer needs minimal to no additional investment

Intellectual Property & Innovation

If the company can demonstrate unique value capture from its existing IP and future innovation.

Business Balance

Ensure the business is not overly reliant on a subset of customers or suppliers.

Product & Channel

A good product and market fit shows that a company has successfully identified both target customer and are serving them with the right product(s).

Brand & Position

The marketing strategy contains the company's value proposition, key brand messaging, data on target customer demographics, and other high-level elements that drive growth.

We like to think of this as business strategy driven by valuation.

Execute Phase - Days 61 to 90

The Execute phase brings together all the previous discovery and preparatory work with the target outcome of having completed preliminary due diligence and received offers / Letter of Intent (LOI) from multiple buyers.

What is Preliminary Due Diligence?

An extremely important and usually the most critical part of the acquisition process is a well-conducted due diligence. Due diligence causes the majority of delays and failures within the sales process. Our 360 Company Report completes Preliminary Due Diligence during the Prepare stage, ensuring your company is ready for sale and that once an offer is accepted, the completion of the transaction is rapid.

Book a Meeting

If you’re thinking of selling your business, meet us face to face to explore your options at a confidential meeting with one of our experienced directors. We’re here to guide you through this process.