Enterprise Software as a Service (SaaS) is a broad horizontal sector united by its focus on providing business solutions. These can be as focused as bespoke solutions for specific industries, such as healthcare customer management and care, or as broad as sales or business intelligence services that can be used by any enterprise regardless of sector, geography, or customer base.

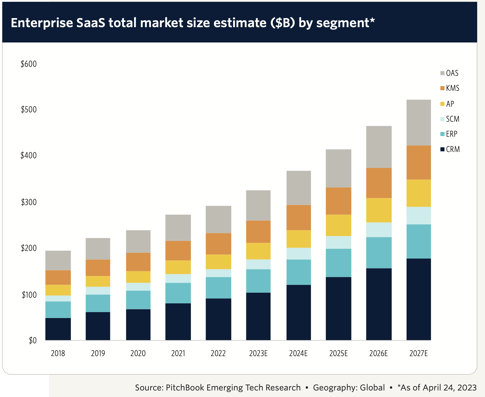

The venture deal count and deal value levels are generally decreasing from the peaks seen in 2021 and 2022. Nonetheless, analysis of market sizing and future growth trends suggests strong industry expansion, which should support venture investment in the space over the long term.

This is especially true as new and disruptive technologies are beginning to be widely adopted across all segments.

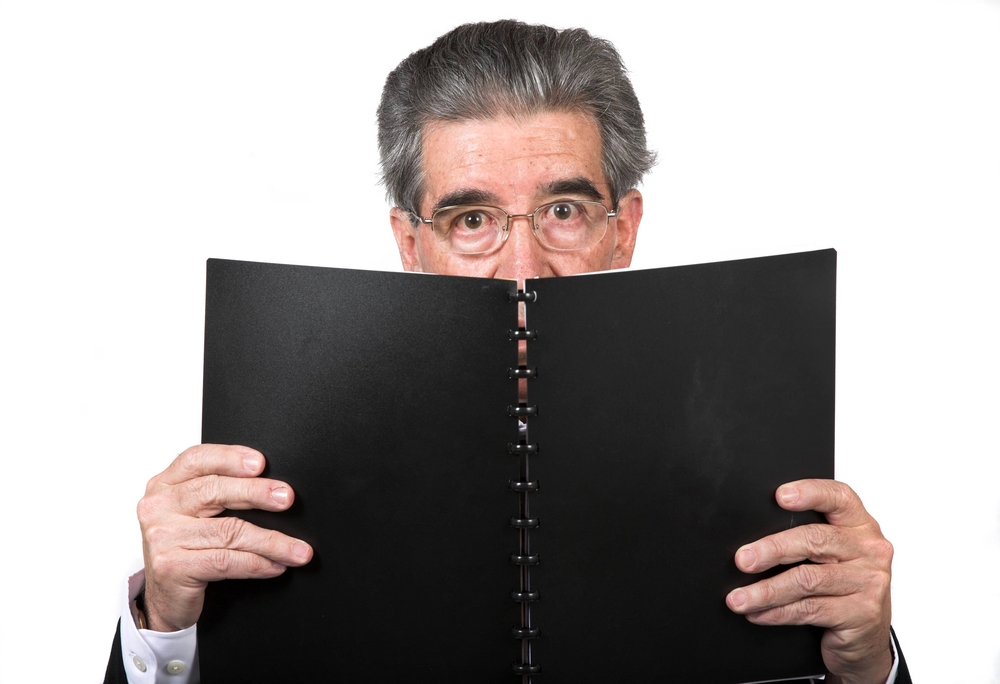

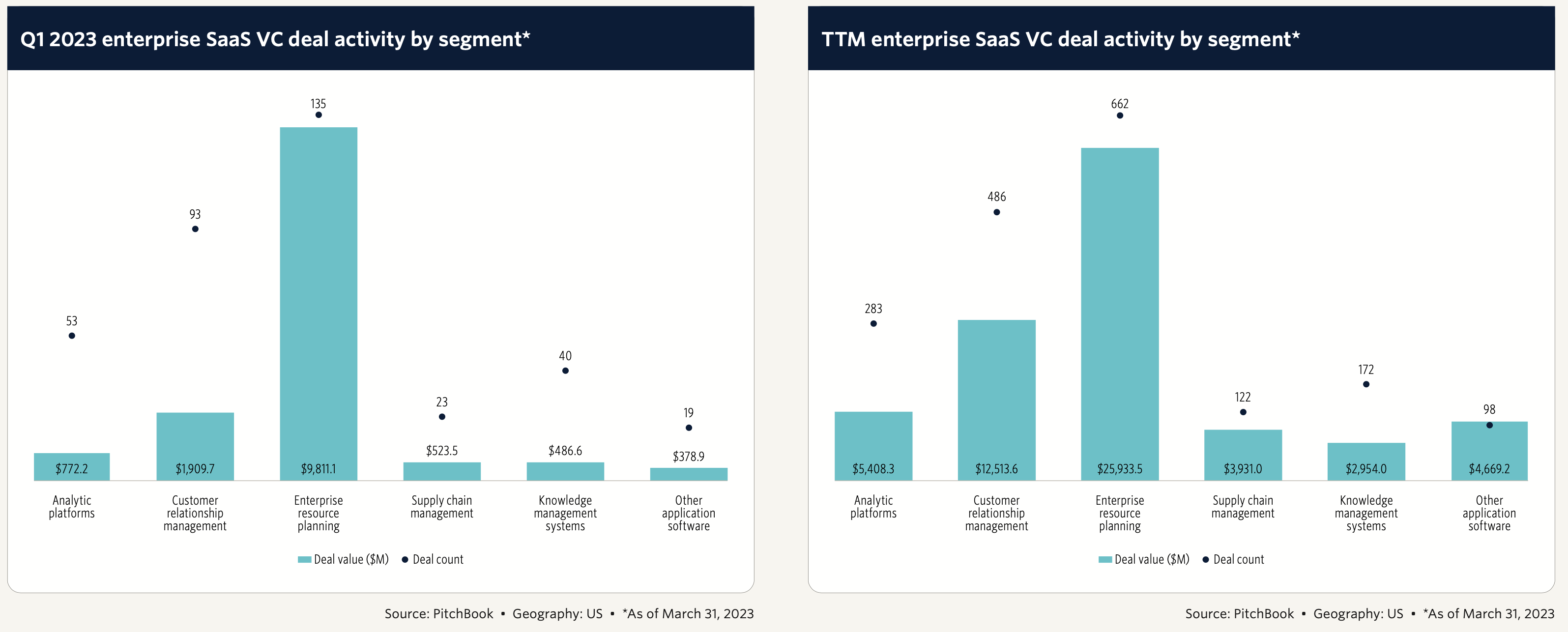

Pitchbook estimates the global enterprise software market size to be $291.8 billion in 2022, up roughly 7.4% from 2021, and expect it to re-accelerate to low-double-digit growth in 2024 and through their outlook period ending in 2027.

Pitchbook finds that enterprises remain focused on transitioning from on-premises deployments to SaaS and cloud-based deployments, though this cycle is likely in its later stages for certain segments, including customer relationship management and knowledge management systems. The integration of AI and intelligent automation into enterprise functions represents an important next-generation driver of growth.

The defined segments within the enterprise SaaS vertical, including key takeaways are.

Customer relationship management (CRM), supporting marketing, sales, and customer service.

Automation and AI-assisted technologies continue to create innovative and disruptive solution sets within the largest enterprise SaaS segment by revenue, driving the expectation of continued growth ahead.

Enterprise resource planning (ERP): Assets, human capital, and operations.

Sector-specific opportunities for incorporating digital transformation and emerging technologies continue to drive widespread investment in the ERP segment, despite current market headwinds having a greater effect on these products.

Supply chain management (SCM): Planning, procurement, and execution.

As supply chain snarls have begun to work themselves out, attention has shifted

to reducing costs in a difficult market, emphasising SCM solutions that deliver efficiencies and greater agility across ever-tenuous global supply chains.

Analytic platforms (AP): Business intelligence, AI, and geospatial analytics.

Analytic platforms are evolving to meet the convergence of both rapidly expanding data creation and major global uncertainty.

Knowledge Management systems (KMS): Content, authoring, and projects.

Enabling worker collaboration and supporting greater productivity among distributed teams has taken precedence across numerous enterprise sectors.

Other application software (OAS): Various emerging solutions for the Enterprise.

Novel solutions enabled by unique applications of emerging technologies are expanding the scope of traditional enterprise applications.

Try our free Valuation Application to see an estimate for your SaaS company.